Hi All,

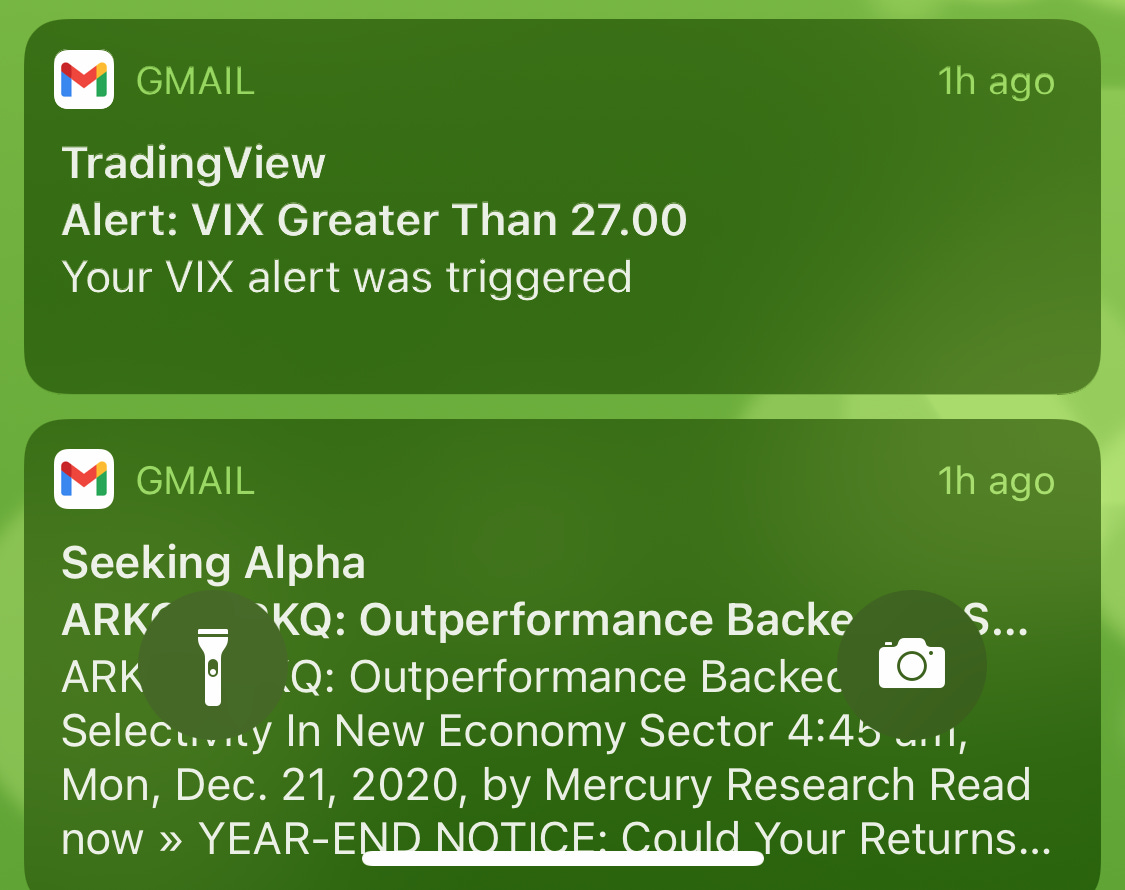

First off, hope you all had a wonderful Christmas break. I ended last week’s newsletter with a “One More Thing…”. That one more thing is exactly what happened Monday morning. The market got rattled. I actually woke up Monday morning to an alert I had setup months ago programmed to go off if the VIX ever goes above 27. This clearly happened because my alert was triggered, which lead me to check the markets and saw the indexes were dropping. This is why I say it’s always a good idea to be prepared and aware. The pullback was short lived and things recovered by Tuesday.

As we exit 2020, we are entering uncharted territory like never seen before. The market is going to be really unpredictable. For me, I’ve mapped out my investing strategy for the next 5-10 years in areas I think will survive the chaos long term.

Looking ahead, I plan to structure my portfolio in the following core areas:

Commodities

Blockchain

FinTech

Healthcare

Innovation

I feel like we are about to witness the greatest wealth transfer in our lifetime. The goal is to come out on the winning side of the trade. How many times have you wished you invested early on into Google, Apple, Shopify, Tesla, Microsoft etc….10+ years ago? Well, now is that opportunity to do so for the next breed of companies that will drive innovation in the next decade.

🔥 IPO Hotlist

Nothing exciting in the pipeline this week due to the holiday season.

⚖️ Watchlist

Here are the stocks I’m monitoring this week for swing trade opportunities:

XL Fleet Corp (XL) - This stock has more than doubled in just 2 weeks. I’m keeping an eye on it because analysts are estimating a $60+ price target long term. The more beneficial play on this will be the warrants (XL/W) which were trading much lower.

Can Fite Biopharma (CANF) - This is a stock I’ve mentioned multiple times here, because I do have a large position in it, but more importantly, I like their pipeline. This is a biotech company based in Israel. Israel is going into another lockdown. This stock might rise in the upcoming weeks due to this momentum.

Boeing Co (BA) - An Air Canada 737-8 Max plane suffered an engine issue last week. This is bad new for Boeing after all the issues that have happened around this plane. The stock may have more downside the next few weeks.

🍯 Bitcoin

Bitcoin crossed the $28K mark this week, establishing a new all time high. The momentum seems to be strong with Bitcoin right now. I’m already up 50% on my BTC holding considering I bought it in the beginning of the month. I get nervous when new highs are established, therefore be very careful. We may get a wild drop soon. I may actually close out my position now in order to secure profit.

Something else I learned this week is that the Facebook cryptocurrency project called “Libra” has actually been renamed to “Diem”. I had no idea, so thought I’d share. Will be interesting to see how this plays out.

🗺 One More Thing…

This week is year end. We could see a large sell off due to tax reasons or we could see a huge rally due to the relief bill being signed. Either way, be careful and always have an exit strategy. Wishing you all a wonderful holiday season and see you in 2021.

🔗 Links

By Filling ‘The Gap’ in the Electric Revolution, XL Stock Will Soar Above $100 - AOL News

Facebook's rebranded cryptocurrency Diem is a 'wolf in sheep's clothing,' Germany's finance minister says - Business Insider

As always, this is not financial advice. I use this as a way to journal my thoughts and share with anyone else interested enough to want to read this, as well as for educational purposes only.